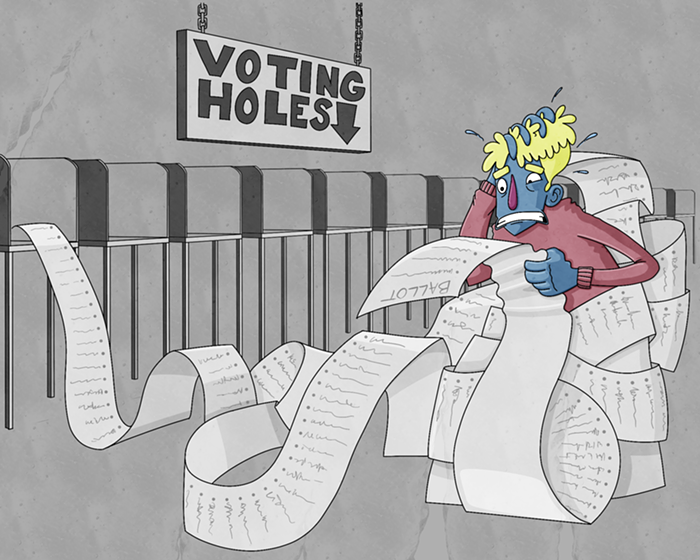

- Illustration by Jess Ruliffson

Every little bit would help the county as it braces for tens of millions in budget cuts coming down from the state and federal governments this spring. And county officials would probably tie a portion of the revenue to public health programs—an easy But good luck getting that message through to lawmakers beholden to the "no tax" types as they close a $3.5 billion deficit, or to the political might and money of institutions like Philip Morris.

A few interesting tidbits, however, didn't make the story. One was just how little the current cigarette tax earns Multnomah County: just about $700,000 a year. Most of the money goes to the Oregon Health Plan and the state's bleeding general fund, with cities and counties left to fight over a combined $15.9 million. County officials don't want to take money from the Health Plan, so that's why they're asking for a local tax that would only augment what we're already getting.

The other was a sense of how Oregon's taxes on cigarettes (and spirits, beer, wine, and gasoline) compare nationally. According to this matrix of 2010 data, we're in the middle, but on the low end. Interestingly, Washington state, since that chart was compiled, hiked its tax by a dollar, to north of $3. That means the Multnomah County tax would have to be almost twice what Oregon already levies before smokers would even consider wasting their gas on a trip over the Columbia for a better deal.