NIKE'S NOT breaking up with Oregon, says Governor John Kitzhaber, but the employer of 8,000 local workers is "actively negotiating" new relationships in other states.

To keep the sportswear giant based in Oregon, Kitzhaber announced a surprise plan on Monday, December 10: an emergency vote by the Oregon Legislature on a law that would let the governor negotiate his own tax agreements with companies looking to seriously invest in Oregon.

The plan—made publicly available by Tuesday, December 11, just three days before the scheduled vote—would let the governor lock in the state's current tax structure for any company promising to add 500 jobs and $150 million in capital investment over five years. Nike is planning an expansion that Kitzhaber says will add 12,000 jobs to Oregon, and the company is "seeking assurance that the state won't change its tax rules after they make this commitment."

"They didn't say, 'If you don't do this, we're leaving,'" said Kitzhaber. "But they did say they have active negotiations with other states."

The move bewildered politicos who say there is no plan afoot to change Oregon's tax structure. Meanwhile, Kitzhaber's proposal could grant the governor powers that circumvent the legislature purely to benefit the bottom line of large corporations.

The proposal also highlights the fact that Oregonians are unable to see how much individual corporations pay in state taxes. Corporate taxes make up 7.2 percent of the state's general fund, but state law bans making individual corporate tax payments public.

The governor is likely moving quickly because the lame-duck legislature that leaves this month (with the House split evenly between Republicans and Democrats) will be an easier sell than next year's.

"I think it's a real bad deal," says Chuck Sheketoff of the progressive tax-watching group Oregon Center for Public Policy (OCPP). "It's wrong for the governor to make a promise that affects a single company."

Potentially driving the deal is a lawsuit filed in July by California-based insurance company Health Net. The lawsuit argues that Oregon's current "single-sales factor" tax structure is unfair, demanding the state switch back to its old tax structure. That system—although more costly to companies like Nike and Intel—cost Health Net less.

Nike is a huge player in the state economy. It's one of Oregon's only two Fortune 500 companies and employs more than 8,000 people locally. Before 2001, Oregon determined corporate taxes based on three factors: payroll, property, and in-state sales. Under pressure from Nike and other large Oregon employers, the rules changed in 2001 to determine taxes based only on in-state sales. The switch to the "single-sales factor" structure—which the governor's plan seeks to lock in—saves Nike $16 million annually, according to an OCPP analysis.

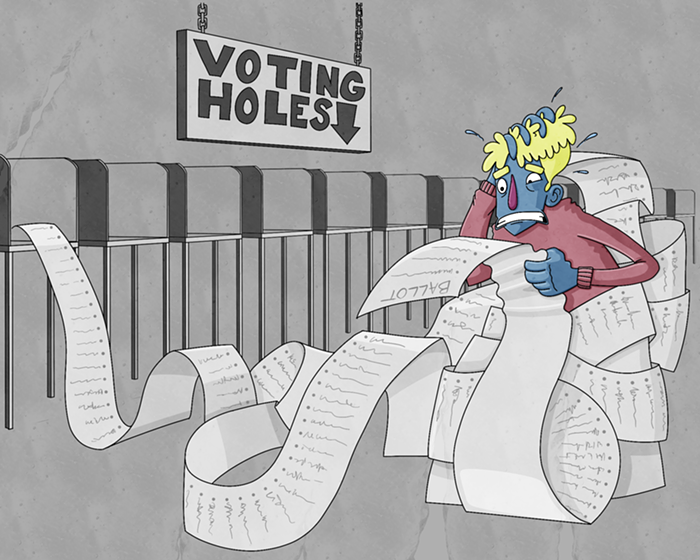

When it meets on Friday, December 14, the resurrected legislature could decide to couple the governor's plan with a law requiring tax transparency for corporations. Otherwise, the public will have to take the governor's word that his plan is "revenue neutral."