IT WAS LATE SEPTEMBER, and a group of bears was in Portland City Hall, dancing to Kool and the Gang.

Portland City Council had just put a bow on years of prodding by activists, vowing to pull all of the city's direct investments out of some of the world's largest fossil fuel companies.

For Portland, that meant more than $60 million invested in ExxonMobil and Chevron would be allowed to expire in coming years. Then the city would formally wipe its hands of those companies—and almost 200 more—for good. Multnomah County made the same pledge.

In doing so, the governments joined a growing list of cities, universities, and churches refusing to use their money to support the fossil fuel industry.

"I wish we were not watching the destruction of the world as we know it," said City Commissioner Steve Novick before voting on the divestment policy. "Unfortunately, it's a scientific fact. This is just one of the steps we need to take."

After the unanimous vote, the bears—a cluster of activists wearing masks made out of disposable plates—got the celebratory dance party underway in the balcony of council chambers. But there was something no one at the hearing mentioned. Portland still invests in fossil fuels. So does the county. And they don't have plans to stop.

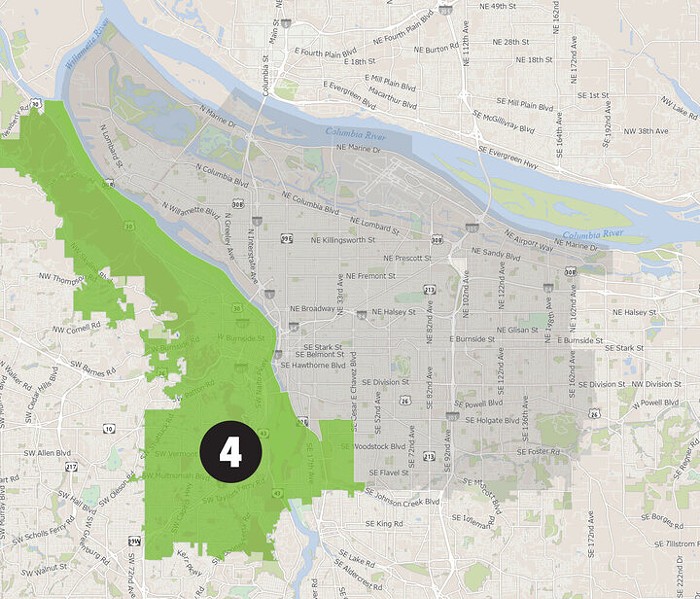

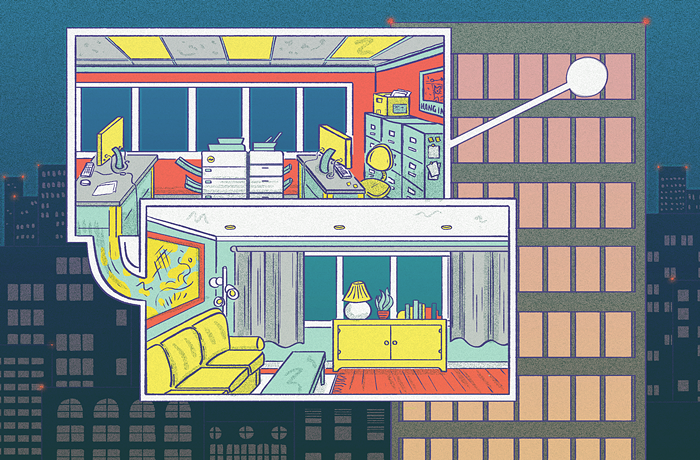

Both entities join hundreds of local governments, school districts, public utilities, and others throughout Oregon in pouring millions of public dollars into something called the Local Government Investment Pool (LGIP), a state-run portfolio created by the state legislature in 1973 to offer cities a safe place to keep cash.

The pool has among its hundreds of holdings investments in six of the oil and gas companies the city and county resolutions deemed the worst of the worst: BP, Royal Dutch Shell, Chevron, Total, CNOOC, and Statoil.

Despite their conscientious divestment, the city and county voluntarily put as much money into the LGIP as state law will allow—a little more than $47 million at any given time. In total, the pool had nearly $8 billion in assets as of December 16, according to data obtained via public records request, though cash can move in and out of the system relatively quickly.

"We use it to the fullest legal extent," says Portland City Treasurer Jennifer Cooperman. "Not participating in the pool really doesn't work."

That's the standard line when you start asking fiscal types about the LGIP. The pool is a useful means for local governments to transfer money to each other, they say. It's safe, and produces good investment returns—in part because oil investments perform reliably well right now (though many argue that will change as the climate does).

Until the state stops investing in oil, in other words, entities all over Oregon are going to be lashed to fossil fuel interests. And the state, right now, is happy with its oil investments.

"Divestment can send a very important symbolic message, but it's just one tool of many," says Oregon Treasurer Ted Wheeler, a central figure in setting the state's investment policy, and a candidate for Portland mayor. Wheeler says he supports moving away from fossil fuels, and would abide by the city's divestment policy if elected mayor. But he also notes the state is bound to do right by the cities that invest in the pool.

"The clear goal is that we maximize returns," Wheeler says, noting cities like Portland are free to "encourage the legislature to change those goals."

In fact, local leaders have done that in the past. During a speech in June 2013, Mayor Charlie Hales said he'd urge state officials to dump Oregon's holdings in fossil fuels—including those in the LGIP.

"Why take this seemingly risky move?" Hales asked at the time. "Because not doing it is the truly risky move."

That sentiment wasn't anywhere to be found on September 24, when council passed its divestment resolution. No one on the dais—Hales included—brought up the fact the city would still be wrapped up in supporting oil companies for the foreseeable future.

In fact, Hales isn't interested in pushing state officials to divest any longer. His office sent a statement to the Mercury, saying, "The state treasurer manages the pool, so it's up to the treasurer to decide how to invest those funds. LGIP divestment from fossil fuel companies is not part of the city's legislative agenda."

These days, most of the pressure being applied to the state to divest from fossil fuels is coming from activists—but it's not aimed at the LGIP. Rather, the group 350PDX, the local wing of 350.org, which encourages divestment around the world, is planning to begin pushing state employees and retirees to urge that their pension funds through the Public Employees Retirement System (PERS) not invest in coal and oil.

"Our idea is to go through PERS, though we wouldn't be opposed to governments asking for a change," says Sandy Polishuk, the divestment coordinator at 350PDX. "There are different ways to get divested."

Change might be on the way, even without that effort. Wheeler says he's asked his staffers to look at how LGIP returns would be affected if fossil fuel investments were done away with.

"Could we create alternative investments that have the same risk-return profiles, but aren't involved in any carbon-based industry?" he asks. "And is there a cost associated with that?"

Wheeler says he doesn't have an answer, and doesn't know when he might. He also says divestment's not the ultimate answer to forcing change at fossil fuel companies.

"What we really need to do is stop buying the damn product."