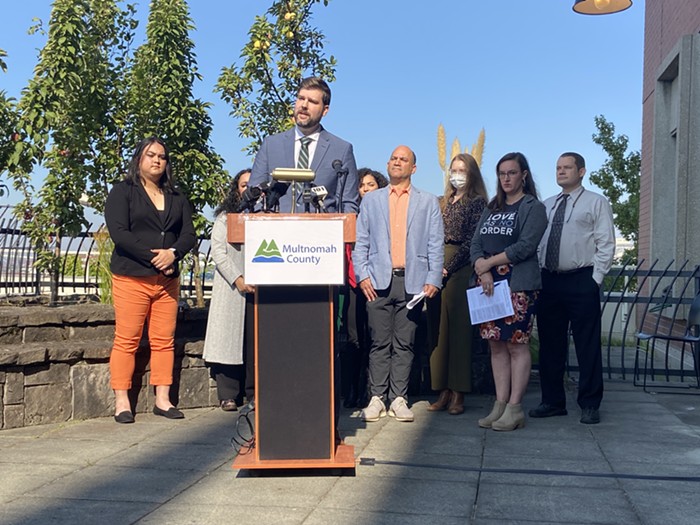

IN THE ONGOING quest for hundreds of millions of dollars to pay for overdue road repairs, City Commissioner Steve Novick thinks he's found a treasure chest of sorts: Oregon's diesel users.

All of them.

As Novick prepares to push a 10-cent local gas tax on May's ballot, he's quietly shopping another idea—one he says would suck up bucks from Burns to Bend to Boardman, and put them into the potholes on your street.

"I'm pretty confident we will move ahead with it," Novick tells the Mercury of the "load fee"he recently pitched to the city's freight advisory committee. "We're comfortable with its legality."

Here's how the fee would work: The majority of Oregon's fuel comes from the Seattle area by pipeline or barge, which then finds a temporary home in a series of enormous tank farms along Highway 30 in Northwest Portland. Chevron, Shell, BP, and other energy giants all have facilities on this six-mile stretch. Novick wants to levy a fee on the enormous tanker trucks that transport diesel fuel from these facilities to gas stations around the state. He's following the lead of the Oregon Office of State Fire Marshal, which already charges $8 when trucks take on bulk fuel loads, netting less than $2 million a year.

Novick would restrict the bulk fee to diesel loads, he says, but would "quite possibly" look to charge well more than $8 for the privilege of acquiring the fuel in Portland.

"The rest of the state will scream that you're passing the tax onto them," Novick says. "But the reality is: Portland is taking on another liability because these tanks could catch fire."

The proposal would be decided by voters, Novick says, but it could be an easy sell. It would potentially inject millions into Portland's transportation system, while costing most Portlanders little and snagging money from the semi-trucks that wreak havoc on city streets. (That separate 10-cent gas tax Novick's planning to put forward omits trucks that weigh more than 26,000 pounds.)

Both the gas tax and Novick's load fee idea have predictable opposition. The Oregon Fuels Association (OFA), which represents gas stations and fuel distributors around the state, has vowed to campaign against the gas tax—the same threat that helped scuttle last year's street fee discussions. The group's executive director, Paul Romain, tells the Mercury it would also fight the fee on diesel.

"In effect he's taxing product for the rest of the state," he says. "I'm not sure he can do that."

Romain's predecessor disagrees. Novick got the idea for the load fee from Brian Boe, a former attorney and lobbyist for the OFA (back when it was called the Oregon Petroleum Marketers Association). In the early '90s, Boe helped lead the charge for a load fee much like the one Novick's pushing: a 1.1-cent per gallon charge that was meant to help gas stations meet environmental regulations.

Legislators enacted the fee in 1991, but the Oregon Supreme Court overturned it the following year after a challenge from the AAA Oregon/Idaho. Under the state's constitution, the court ruled, revenue from the fee had to go toward fixing and building highways, not gas stations.

Boe thinks the fee Novick's contemplating passes the legal test, "because it's being used for road maintenance and construction."

"There's an argument that can be made—and I think a pretty significant one—that that area [of Northwest Portland] serves as a hub for getting the fuel to the entire state," Boe says. "The City of Portland shoulders a unique liability there. We all know the risk we're at for a large earthquake."

State officials back up this argument. A 2012 report from the Oregon Department of Geology and Mineral Industries found "major seismic vulnerabilities exist" in the stretch of industrial land that includes these massive tank farms. "Some critically important structures appear to be susceptible to significant damage in a major earthquake," the report found.

For now, the load fee idea will take a backseat to the gas tax proposal, which Novick will put before Portland City Council on January 27, hoping to convince commissioners to refer it to May's ballot. Even if the four-year tax passes, though, it'd only raise about $16 million a year. Meanwhile, estimates suggest that Portland needs to be spending more than $100 million every year for the next decade in order to get its roads up to snuff.