In Germany, riding the subway without buying a ticket is called schwarzfahren—quite literally “riding in the dark.” While it saves you money on the ticket, you’re always riding the train with a lingering fear that a fare inspector is going to discover you and slap you with a massive fine. Defaulting on your student loans is pretty much the millennial American version of schwarzfahren. You can’t ignore your student loans into going away (even declaring bankruptcy won’t get rid of them). Not paying on them might save you money month-to-month, but it will cost you a lot more in the long run.

Having student loans in default will hurt your credit—which can really impact your ability to get a place to live in Portland’s competitive market. But more than that, it also tends to weigh on your psyche, just waiting for that student loan “fare inspector” to find you.

If you haven’t paid your student loans in 270 days, you will be considered in default. Student loan default is something you can recover from, though. The very first step is to take a deep breath. Make yourself a nice beverage, because you’re probably going to have to make some frustrating calls.

The next thing to get a handle on is what and who you owe. The way loans work in the US is that quite often they’re split up between multiple providers. So, for your federal loans, the best place to go is the NSLDS (National Student Loan Data System). You’ll need to know your Federal Student Aid (FSA) ID, which is how you log into the Free Application for Federal Student Aid (FAFSA). This is important because you’ll use it to access the various government websites that show your federal loans. If you don’t remember or can’t find it, you can reset it at studentaid.ed.gov—or call 1-800-4-FED-AID and they’ll walk you through it.

The NSLDS does not have data on older loans—for example, ones borrowed in the 1980s. It also doesn’t list medical and nursing school loans or private loans. If you have loans that are in one of those three categories and are still in repayment, you’ll have to locate them by looking at your credit report. You can get a free credit report from the three main credit reporting agencies—Experian, TransUnion, and Equifax—by visiting annualcreditreport.com. Warning: Credit reports read like hieroglyphics. You can also use a free credit check website like creditkarma.com to look at a prettier version of your report. I recommend getting both to cover all your bases. DO NOT focus on your score, which is likely not great if you’ve defaulted on your loans. Just focus on the fact-finding.

Once you have a list of all your loans, you can log in to studentloans.gov and use the repayment plan estimator to see your different repayment options. What you want to figure out is what’s affordable for you. If your income is variable month-to-month, see if you can get a repayment amount that’s affordable on your lowest-earning months.

You will have to call your loan provider—possibly a collections agency, depending on how defaulted you are—in order to get your loan in rehabilitation. To qualify for loan rehabilitation for most loans, you have to make nine monthly payments within 20 days of the due date during a period of 10 consecutive months. The nine out of 10 rule basically allows you to miss your payment one month, and still be eligible to rehabilitate. For the Perkins loans you have to make nine out of nine payments on time.)

If you’ve struggled to get out of default on your student loans because the payments are unachievable, you should ask about IBR (income-based repayment), which will set the amount you pay each month to a percentage of your discretionary income. You can enroll in income-driven repayment plans even if you’re unemployed! You could be making zero monthly payments and still be in good standing on your loans. Keep asking for a payment plan and don’t stop until you get something you can afford.

Once you’ve actually made that scary call to start the rehabilitation process on your student loans, try to prevent defaulting again AND save yourself money by signing up for automatic payments. Some lenders offer a 0.25 percent discount on your interest rate if you sign up, so do it!

The best way to approach this process is like a detective: cool and detached. Try to take shame out of the equation (I know that’s easier said than done). It’s possible you may have to make a lot of soul-sucking calls, so make sure to give yourself a treat (chocolate or whiskey, anyone?) when you’re done—because you did the thing! Congratulations!

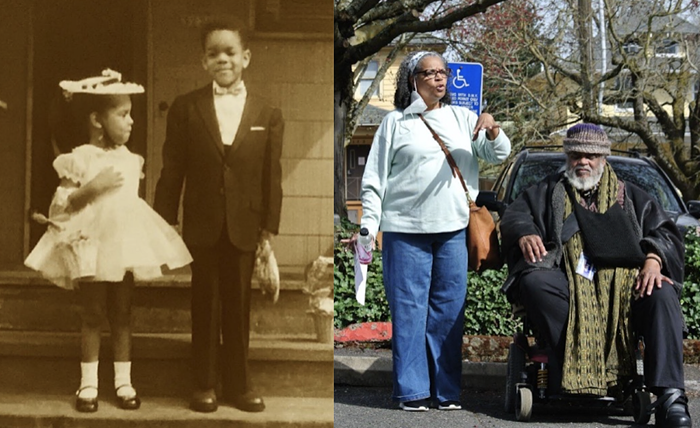

Lillian Karabaic is host of the weekly Oh My Dollar! radio show and podcast on XRAY (107.1 FM) and author of Get Your Money Together, a cat-filled, friendly guide to purrsonal finance.