HOMEOWNERS AROUND OREGON who fall into foreclosure because of fine print and lost paperwork may be the victims of fraud. But misleading lenders can't be prosecuted because a loophole in Oregon law exempts mortgage banks from the state's Unlawful Trade Practices Act.

Fortunately, that might be about to change.

A mortgage broker for 15 years, Northeast Portland homeowner Anne McAvoy never dreamed she would face foreclosure. Mortgage lender Provident Funding repeatedly told McAvoy that her loan would stay at the same interest rate for 30 years, she says. But over the summer the interest rate jumped, and McAvoy had to bail on the house that was supposed to fund her retirement and her son's college tuition.

"Now I don't have either," said McAvoy on Friday, January 15, the day her foreclosed home was set for sale.

The Bloebaums, a couple in their 60s who both still hold jobs to pay off their three-bedroom house in Lents, thought they bought a fixed-rate mortgage from Countrywide. But last July their interest jumped $500 a month, and now the couple can't afford to pay. "I'm sick of the whole business. I think the bank committed fraud," says Charlotte Bloebaum.

The Oregon Unlawful Trade Practices Act authorizes the attorney general to prosecute businesses for fraud based on citizen complaints. But mortgage banks and insurance companies receive a special exemption from that law.

That loophole allows lenders to engage in rampant irresponsible behavior with no punishment, says East Portland Representative Nick Kahl. Last week, Kahl introduced House Bill 3615, which would allow the attorney general, John Kroger, to prosecute citizen complaints about mortgage banks' false or predatory lending. Kroger received 742 complaints about financial institutions last year and attorney generals of states ranging from Ohio and Illinois to Massachusetts and New York have filed suits against mortgage banks and lenders for fraud.

"Every other business in the state of Oregon, if they rip off the consumer, they're going to be held accountable," says Kahl.

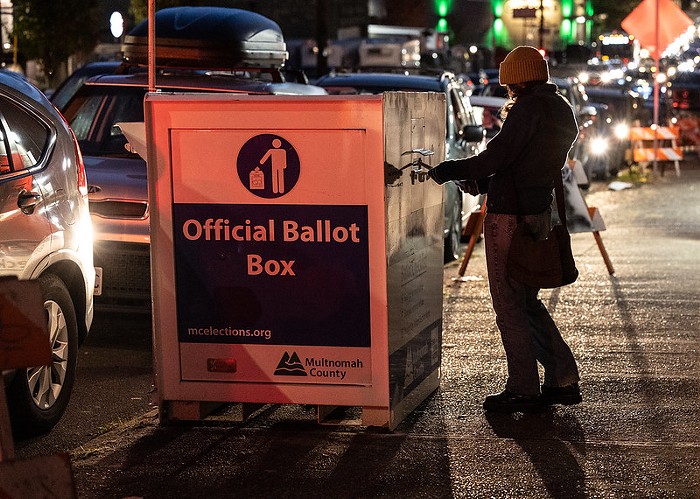

Just in Multnomah County, 758 homes filed for foreclosure in December 2009. Nationwide, only 66,000 people out of the four million eligible Americans have been able to modify their home loans under President Obama's much-lauded program meant to help homeowners into more affordable loans, according to a national report on the housing crash.

"I don't know if it's incompetence or if there's something else behind it," says Jon Bartholomew of consumer-advocacy group Oregon State Public Interest Research Group.

A Gresham family in Bartholomew's files thought they were in a 30-year fixed-rate mortgage but when their interest unexpectedly jumped, Bartholomew helped them comb through stacks of paperwork. In fine print in parentheses on one page were the letters "ARM"—which stands for "adjustable-rate mortgage."

"They were looking at losing their home because somewhere in the paperwork was this shady little deal that said their interest was going to go up," says Bartholomew.

Consumer advocate Angela Martin, with Our Oregon, hears very similar complaints about lost paperwork, denied modifications, and sneaky fine print from the homeowners she works with. The Our Oregon office currently has four interns trying to call 2,000 people statewide who have gone into foreclosure and offer free counseling, she says.

The other side does not think letting the attorney general prosecute mortgage banks for fraud will do any good.

"I wouldn't deny that there are problems but the lenders are working hard to fix those problems," says Oregon Mortgage Lenders Association lobbyist Jim Markee, who argues that modifications are slow in coming because lenders are overwhelmed with requests.

Lobbyists from the Oregon Financial Services Association and insurance companies told the legislature in a hearing last week that Kahl's proposed law is unnecessary since the state already has pages of laws regulating Oregon banks and insurance companies.

Back out in Lents, the Bloebaums say they left daily voicemails for Bank of America that went unreturned.

"Panic city set in," says Charlotte Bloebaum, who was finally able to get through to her bank and work a temporary interest reduction with the help of a foreclosure counselor. When the temporary modification expires in three months, she and her husband don't know what they're going to do. But Bloebaum is sure about one thing.

"It's going to take a bulldozer to move me out of my house," she says.