Multnomah County Commissioner Loretta Smith owes $36,723 in back taxes, penalties, and interest according to a document obtained by the Mercury from the county's Assessment and Taxation office.

A distraint warrant from the Oregon Department of Revenue was filed against Smith with the Multnomah County Assessment and Taxation Office in June, detailing the commissioner owes $26,695.92 in taxes, $6,706.80 in penalties and fees, and $3,270.27 in interest for the taxation period ending in December 2012. The NE 6th Avenue address listed in the document for Loretta J. Smith matches an address listed for Smith in old campaign filings.

"This warrant has been issued against the above named debtor(s) because the debt shown below has not been paid in full," the June 3 document says. "This warrant serves the same function as a court judgement. We use the warrant in collection action such as garnishment of wages and bank accounts, property seizures, federal tax tax refund offset, and creation of property liens."

Smith, meanwhile, chocks the lien up to a misunderstanding. She says the state misclassified her former home as a rental property when she filed her 2012 return. She sold it shortly afterward, and says she never received a letter or call about her debt.

Public records obtained in a records request show $805.39 is deducted from Smith's semi-weekly pay check.

There are a lot of ways distraint warrants can come to be filed, but the bottom line is the state seeks garnishments when someone hasn't acted in good faith when it comes to paying their taxes. Smith's case involves unpaid personal income taxes.

"We will send letters to the last address we have for them," says Bob Estabrook, a spokesperson for the Oregon Department of Revenue. "We will follow up with a phone call try to reach them that way. The trigger really is we’ve tried to reach out to the taxpayer to get them to some kind of payment arrangement."

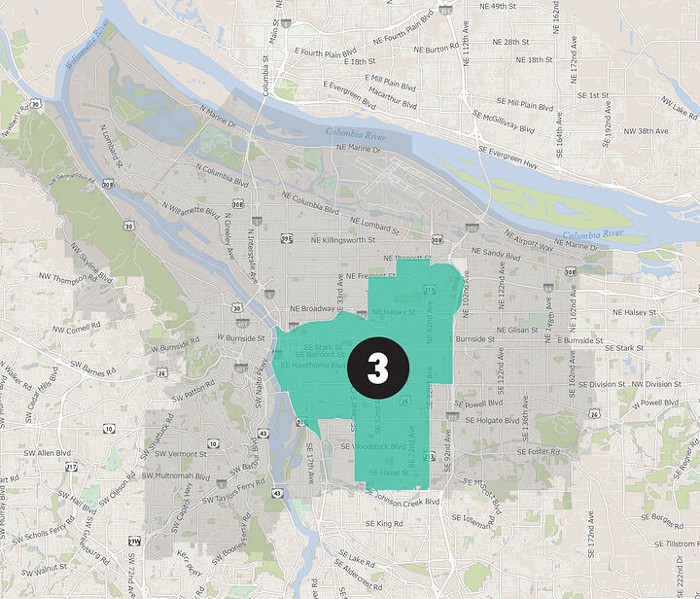

The address the state has listed for Smith in the tax document is defunct. She now lives in East Portland.

"The garnishment is wrong," Smith told the Mercury this afternoon. She was calling from Philadelphia, where she's attending the Democratic National Convention. "I moved and the State of Oregon was sending me notices after I filed that I owed something else. I didn't get those notices."

Smith says her 2012 taxes showed she owed just $49 to the state that year, not more than $26,000. She says her personal accountant went back through the return today, and believes state employees erroneously assigned the higher tax.

Even though the state filed the lien with Multnomah County in early June, Smith says she only recently learned about it. "You won't believe this, but I didn't see this until two days ago," she says. "For whatever reason, someone leaked it to the press, but they failed to bring it upstairs to show me."

The state isn't the only entity saying Smith owes it money. Earlier this month, the county also received a claim from River View Village Homeowners Association in Tigard, claiming Smith owes $460.40 for "unpaid assessments" and various other charges. Smith says that's a charge she's currently disputing with her home owner's association.

Smith was elected to the county commission in 2010 leaning partly on her long-term employment for US Sen Ron Wyden. The lien document suggests, then, that Smith didn't pay taxes while in elected office. As of last year, county commissioners made $99,946 a year.

Smith's well known for championing employment opportunities for disadvantaged teens, but her money management hasn't been blemish-free. A 2015 story in Willamette Week reported Smith spends far more than her colleagues on travel expenses—sometimes questionably.

In recent months, Smith has spoken out in favor of a (failed) business tax hike proposed by Portland Mayor Charlie Hales. She's also criticized the establishment of a new 200-bed homeless shelter in a county building at NE 122nd and Glisan.